Date: January 9, 2026

Foreword

This comprehensive guide is designed for professionals and enthusiasts seeking an in-depth understanding of corporate loan management. It delves into the intricate mechanisms of various loan facilities, the meticulous processes governing their lifecycle, the critical role of risk management, and the nuanced financial and regulatory considerations that shape the corporate lending landscape. Our aim is to provide an expert-level resource that covers every aspect from initial application to final repayment, including specialized facilities like Letters of Credit, Letters of Guarantee, Project Finance, and the implications of Foreign Direct Investment.

Chapter 1: Foundations of Corporate Lending

Corporate lending is a cornerstone of economic activity, providing businesses with the capital necessary for growth, operations, and strategic initiatives. Unlike retail lending, corporate loans are often complex, highly structured, and tailored to the specific needs and risk profiles of corporate entities.

1.1. Core Principles of Corporate Credit

At its heart, corporate lending revolves around assessing and managing credit risk. Lenders evaluate a borrower’s ability and willingness to repay debt, considering factors such as:

- Cash Flow Generation: The primary source of repayment for most corporate loans.

- Asset Quality: The value and liquidity of assets that can serve as collateral.

- Management Expertise: The competence and integrity of the borrower’s leadership.

- Industry and Economic Conditions: External factors influencing the borrower’s business environment.

1.2. Parties Involved in a Corporate Loan Transaction

Beyond the direct borrower and lender, several other parties often play crucial roles, especially in larger or syndicated transactions:

- Borrower: The corporate entity receiving the funds.

- Lender(s): Financial institutions providing the capital. This can be a single bank (bilateral loan) or a syndicate of banks (syndicated loan).

- Lead Arranger/Bookrunner: In syndicated loans, the bank responsible for structuring the deal, underwriting, and distributing the loan to other lenders.

- Facility Agent: Appointed by the syndicate, this bank manages the ongoing administration of the loan, including drawdowns, repayments, and communication between the borrower and lenders [1].

- Security Trustee/Agent: Holds the collateral on behalf of all lenders in a secured syndicated transaction, simplifying the enforcement process in case of default [2].

- Legal Counsel: Advises all parties on legal aspects, drafts and reviews documentation.

- Financial Advisors: May assist the borrower in structuring the financing and negotiating terms.

Chapter 2: Diverse Corporate Loan Facilities

Corporate loan facilities are highly diverse, each designed to address specific financing requirements. Understanding their mechanics is crucial for effective loan management.

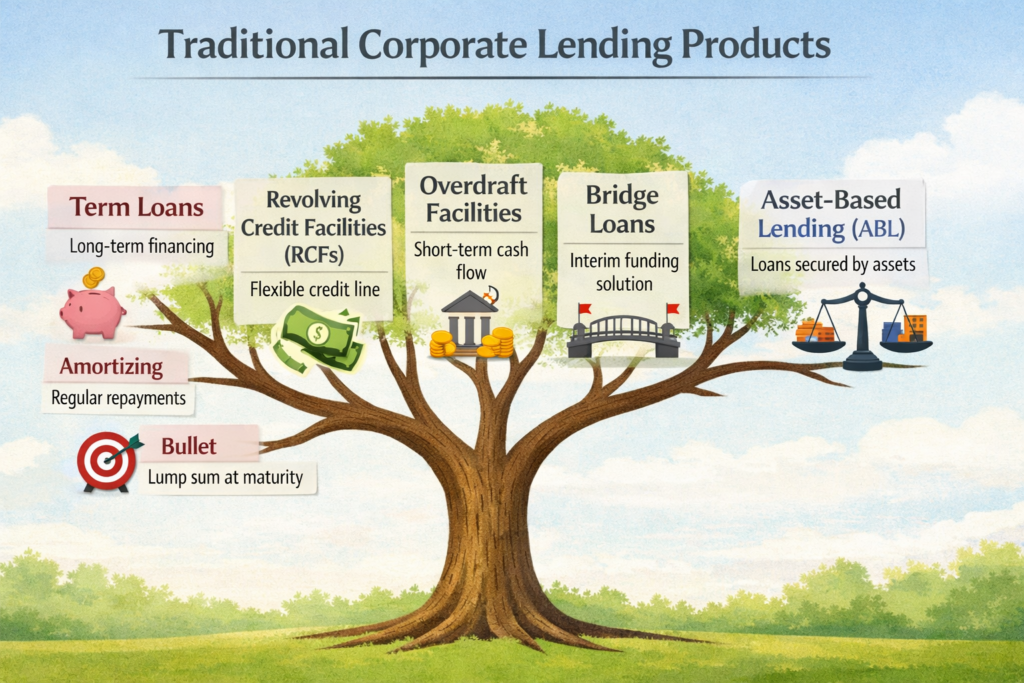

2.1. Traditional Lending Products

2.1.1. Term Loans

Term loans provide a lump sum of capital that is repaid over a predetermined period. They are typically used for significant capital expenditures or long-term investments.

- Amortizing Term Loan: The most common type, where principal and interest payments are made regularly over the loan’s life, gradually reducing the outstanding balance. Payments can be equal installments or structured to match projected cash flows.

- Bullet Term Loan (or Balloon Loan): Only interest payments are made during the loan’s term, with the entire principal amount due as a single

repayment at maturity. This structure is often used when a borrower anticipates a large cash inflow (e.g., from an asset sale or refinancing) at the end of the term. - Mini-Perm Loan: A short-term (typically 3-5 years) bullet loan often used in project finance to bridge the gap between construction completion and securing long-term, permanent financing.

2.1.2. Revolving Credit Facilities (RCFs)

RCFs offer flexibility, allowing borrowers to draw, repay, and redraw funds up to a specified limit during the facility’s term. They are essential for managing working capital and short-term liquidity needs.

- Mechanics: The borrower can access funds as needed, and interest is typically charged only on the drawn amount. A commitment fee is usually charged on the undrawn portion of the facility [3].

- Drawdowns: Funds are requested by the borrower, often with a short notice period (e.g., 1-3 business days), and disbursed by the agent bank (in syndicated facilities).

- Repayments: Borrowers can repay drawn amounts at any time, freeing up capacity to redraw. Scheduled repayments may also be required, particularly if the facility is nearing maturity or if certain financial covenants are breached.

- Evergreen Clause: Some RCFs include an evergreen clause, allowing for automatic extensions of the maturity date if certain conditions are met, providing continuous access to liquidity.

2.1.3. Overdraft Facilities

Similar to RCFs but typically for smaller amounts and shorter durations, overdrafts allow a company to temporarily overdraw its current account up to an agreed limit. They are primarily used for managing day-to-day cash flow fluctuations.

2.1.4. Bridge Loans

Bridge loans are short-term loans designed to provide immediate cash flow until a more permanent financing solution is secured. They are common in mergers and acquisitions, real estate transactions, or during periods of corporate restructuring.

2.1.5. Asset-Based Lending (ABL)

ABL facilities are secured by specific assets, such as accounts receivable, inventory, or equipment. The borrowing base (the maximum amount that can be borrowed) is dynamically calculated based on the value and eligibility of these assets. ABL is particularly attractive to companies with significant tangible assets but potentially weaker cash flows or credit histories.

2.2. Trade Finance Facilities: Letters of Credit (LC) and Letters of Guarantee (LG)

Trade finance instruments play a crucial role in mitigating risks in domestic and international trade, facilitating transactions between parties who may not have established trust.

2.2.1. Letters of Credit (LC)

A Letter of Credit is a payment undertaking by a bank on behalf of a buyer (applicant) to a seller (beneficiary). The bank guarantees payment to the seller, provided the seller presents documents that comply with the terms and conditions of the LC [4].

- Key Parties:

- Applicant (Buyer/Importer): Requests the LC from their bank.

- Issuing Bank: The buyer’s bank that issues the LC.

- Beneficiary (Seller/Exporter): The party who receives payment under the LC.

- Advising Bank: A bank, usually in the seller’s country, that authenticates the LC and advises it to the beneficiary.

- Confirming Bank (Optional): A bank that adds its own undertaking to the issuing bank’s, providing an additional layer of payment guarantee, especially in higher-risk markets.

- Operational Flow:

- Buyer and Seller agree on a trade contract, specifying payment via LC.

- Buyer applies to their Issuing Bank for an LC.

- Issuing Bank issues the LC and sends it to the Advising Bank.

- Advising Bank authenticates and forwards the LC to the Seller.

- Seller ships goods and presents required documents (e.g., bill of lading, commercial invoice, packing list) to their bank (often the Advising Bank).

- The bank checks documents for compliance with LC terms.

- If documents are compliant, the bank forwards them to the Issuing Bank.

- Issuing Bank verifies documents. If compliant, payment is made to the Seller.

- Issuing Bank debits the Buyer’s account and releases documents, allowing the Buyer to take possession of the goods.

- Types of LCs:

- Commercial LC: The most common type, used for direct payment in trade transactions.

- Standby LC (SBLC): Functions more like a guarantee. The bank pays the beneficiary only if the applicant defaults on its contractual obligations. It is a secondary payment mechanism, unlike a commercial LC which is a primary one [5].

- Revolving LC: Allows the amount of the LC to be reinstated after it has been drawn, up to the original amount, for a specified number of times or period.

- Transferable LC: Allows the original beneficiary to transfer all or part of the LC to a third party (e.g., a supplier).

- Back-to-Back LC: Two LCs are issued, one by the buyer’s bank to an intermediary, and another by the intermediary’s bank to the actual supplier, using the first LC as collateral.

- Sight LC: Payment is made immediately upon presentation of compliant documents.

- Usance LC (or Term LC): Payment is made after a specified period (e.g., 30, 60, 90 days) after presentation of compliant documents [6].

2.2.2. Letters of Guarantee (LG) / Bank Guarantees

A Letter of Guarantee (or Bank Guarantee) is an undertaking by a bank to pay a beneficiary a specified sum if the applicant fails to perform a contractual obligation. Unlike an LC, an LG is typically a secondary obligation, meaning the bank pays only upon default of the applicant [7].

- Key Parties:

- Applicant: The party requesting the guarantee.

- Guarantor (Issuing Bank): The bank issuing the guarantee.

- Beneficiary: The party in whose favor the guarantee is issued.

- Types of LGs:

- Performance Guarantee: Assures the beneficiary that the applicant will perform its contractual obligations (e.g., completing a project on time).

- Bid Bond/Tender Guarantee: Guarantees that a bidder will enter into a contract if their bid is accepted.

- Advance Payment Guarantee: Guarantees that an advance payment made to the applicant will be returned if the applicant fails to fulfill the contract.

- Financial Guarantee: Guarantees a financial obligation, such as repayment of a loan.

- Customs/Excise Guarantee: Guarantees payment of customs duties or excise taxes.

2.3. Project Finance Facilities

Project finance is a method of funding large-scale infrastructure and industrial projects (e.g., power plants, toll roads, mines) using a non-recourse or limited-recourse financial structure. The financing is primarily based on the project’s projected cash flows, rather than the balance sheets of the project sponsors.

- Special Purpose Vehicle (SPV): A critical element of project finance is the creation of a legally independent entity, the SPV (also known as a Project Company), to own and operate the project. This isolates the project’s risks and assets from the sponsors’ other businesses [8].

- Debt Sizing: The amount of debt a project can support is determined by its ability to generate sufficient cash flow to cover debt service, often measured by the Debt Service Coverage Ratio (DSCR).

- Cash Flow Waterfall: A predefined hierarchy for distributing the project’s cash flows, ensuring that senior debt obligations are met before any distributions to equity holders. A typical waterfall prioritizes: operating expenses, taxes, debt service (principal and interest), debt service reserve accounts, and finally, distributions to equity [9].

- Key Risks: Construction risk, operational risk, market risk, political risk, environmental risk.

- Covenants: Project finance agreements are heavily covenanted, including financial ratios, completion guarantees, insurance requirements, and restrictions on additional debt.

2.4. Foreign Direct Investment (FDI) Related Facilities

FDI involves an investor establishing foreign business operations or acquiring foreign business assets. Corporate loan facilities often support FDI initiatives, subject to specific regulatory frameworks.

- Types of Facilities: Term loans, RCFs, and guarantees can all be used to finance FDI. These might be provided by local banks in the host country, international banks, or multilateral financial institutions.

- Regulatory Compliance: FDI-related loans are subject to both the home country’s and host country’s regulations, including foreign exchange controls, capital repatriation rules, and sector-specific investment restrictions. Tax implications, such as withholding taxes on interest payments, are also crucial considerations [10].

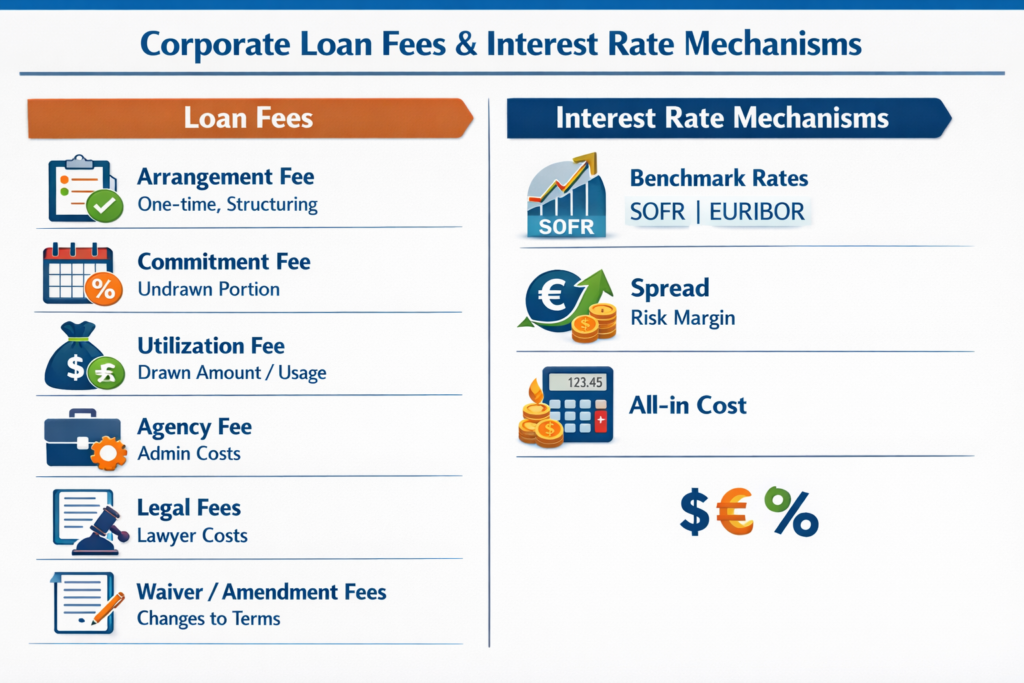

Chapter 3: Fees, Interest, and Tax Implications

Corporate loans involve various costs beyond the principal amount, including fees, interest, and tax considerations. Understanding these components is essential for accurate financial modeling and cost management.

3.1. Loan Fees

Fees compensate lenders for their services, risk, and the administrative burden of managing a loan facility.

- Arrangement Fee (or Upfront Fee/Facility Fee): A one-time fee paid to the lead arranger(s) for structuring and syndicating the loan. It is typically a percentage of the total loan amount and is paid at closing [11].

- Commitment Fee: Charged on the undrawn portion of a committed facility. This compensates the lender for reserving capital and being ready to disburse funds. It is usually an annual percentage (e.g., 0.25% – 0.50%) of the unused commitment [12].

- Utilization Fee (or Drawdown Fee): A fee charged if the borrower’s outstanding balance exceeds a certain percentage of the available credit, or sometimes on each drawdown. It incentivizes efficient use of the facility [13].

- Agency Fee: An annual fee paid to the facility agent for its ongoing administrative services throughout the life of a syndicated loan.

- Legal Fees: Cover the costs incurred by the lender for legal counsel in drafting and negotiating loan documentation. These are typically passed on to the borrower.

- Waiver/Amendment Fees: Charged when the borrower requests changes to the loan agreement (e.g., waiving a covenant breach or amending a term).

3.2. Interest Rate Mechanisms

Corporate loan interest rates are typically floating, meaning they adjust periodically based on a benchmark rate plus a spread.

- Benchmark Rates:

- SOFR (Secured Overnight Financing Rate): The primary benchmark rate for USD-denominated loans, replacing LIBOR. It is a broad measure of the cost of borrowing cash overnight collateralized by Treasury securities.

- EURIBOR (Euro Interbank Offered Rate): A benchmark rate for Euro-denominated loans.

- Other Local Interbank Rates: Various countries use their own interbank offered rates (e.g., SONIA in the UK, TIBOR in Japan).

- Spread: A margin added to the benchmark rate, reflecting the borrower’s credit risk, the loan’s tenor, market conditions, and the lender’s desired profit margin. The spread can be fixed or can step up/down based on the borrower’s financial performance (e.g., leverage ratio).

- All-in Cost: The total cost of borrowing, including the benchmark rate, spread, and annualized fees.

3.3. Tax Implications

Corporate loan transactions have significant tax implications for both borrowers and lenders, varying by jurisdiction.

- Withholding Tax (WHT): A tax withheld by the borrower (payer) on interest payments made to a foreign lender. The rate of WHT is often reduced or eliminated by Double Taxation Treaties (DTTs) between countries [14].

- Stamp Duty: A tax levied on legal documents, including loan agreements and security documents, in many jurisdictions. The amount can be a fixed fee or a percentage of the loan amount.

- Thin Capitalization Rules: Many countries have rules to prevent companies from being excessively debt-financed (thinly capitalized) to reduce taxable income through interest deductions. These rules may disallow interest deductions on debt exceeding a certain debt-to-equity ratio or a percentage of EBITDA [15].

- Deductibility of Interest and Fees: Generally, interest expenses and certain loan fees are tax-deductible for the borrower, reducing their taxable income. However, specific rules and limitations apply in each jurisdiction.

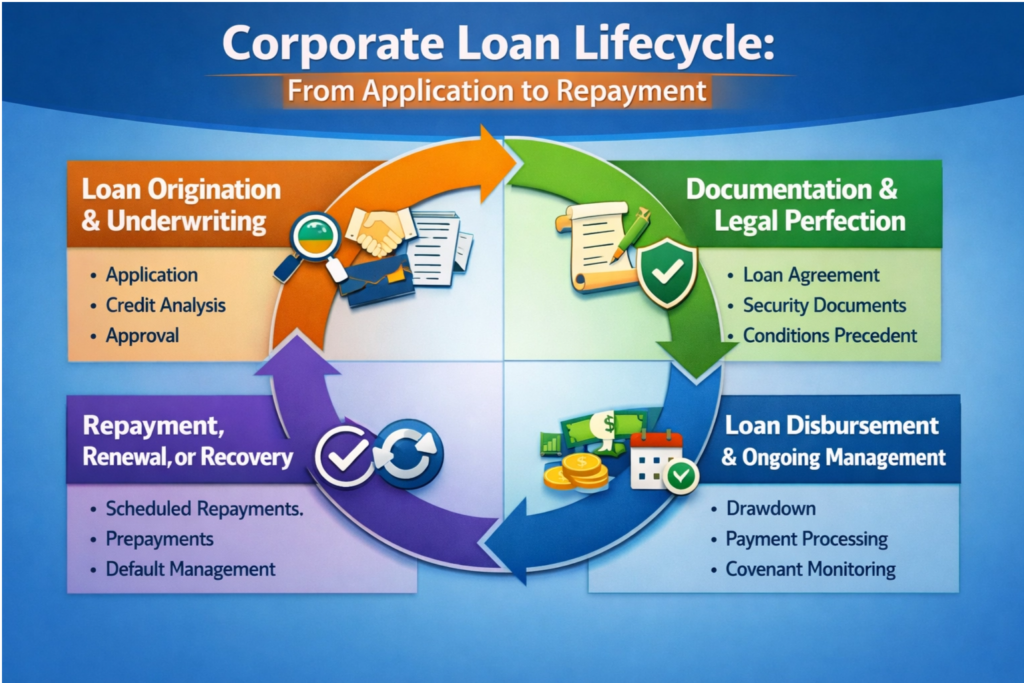

Chapter 4: The Corporate Loan Lifecycle: From Application to Repayment

The corporate loan lifecycle is a structured process designed to manage credit risk and ensure efficient operations. It can be broadly divided into several stages.

4.1. Stage 1: Loan Origination and Underwriting

This initial phase is critical for assessing creditworthiness and structuring the appropriate financing solution.

4.1.1. Application and Initial Screening

- Information Gathering: The borrower submits a detailed application package, including:

- Company profile, business plan, and management team details.

- Historical financial statements (audited, typically 3-5 years).

- Financial projections (income statement, balance sheet, cash flow).

- Details of existing debt and banking relationships.

- Purpose of the loan and proposed repayment sources.

- Industry analysis and competitive landscape.

- Preliminary Assessment: The bank’s relationship manager conducts an initial review to determine if the request aligns with the bank’s lending policies and risk appetite. This involves a high-level assessment of the borrower’s financial health and industry.

4.1.2. Credit Underwriting and Analysis

This is the core of the credit decision process, involving a deep dive into the borrower’s financial and operational standing.

- The Five C’s of Credit:

- Character: The integrity and trustworthiness of management. Assessed through background checks, industry reputation, and past dealings.

- Capacity: The borrower’s ability to generate sufficient cash flow to repay the loan. Analyzed through historical and projected cash flow statements, debt service coverage ratios (DSCR), and interest coverage ratios (ICR).

- Capital: The borrower’s financial strength, indicated by its equity base and leverage. A strong capital base provides a buffer against unexpected losses.

- Collateral: Assets pledged to secure the loan, providing a secondary source of repayment in case of default. Valuation and perfection of security interests are key.

- Conditions: Economic and industry-specific factors that could impact the borrower’s ability to repay. This includes market trends, regulatory changes, and competitive pressures.

- Financial Modeling: Creation of detailed financial models to project future performance, test various scenarios (e.g., stress testing), and calculate key financial ratios.

- Risk Rating: Assignment of an internal credit rating to the borrower, reflecting the probability of default. This rating influences pricing and internal capital allocation.

- Internal Bank Approval Process: Corporate loan approvals typically follow a hierarchical structure:

- Relationship Manager (RM): Prepares a credit proposal outlining the borrower’s profile, loan request, risk assessment, and proposed terms.

- Credit Analyst: Reviews the RM’s proposal, conducts independent analysis, and prepares a detailed credit memorandum.

- Credit Committee: A multi-level committee (e.g., local, regional, central) reviews and approves loans based on their size and complexity. The committee assesses the risks, proposed mitigants, and adherence to credit policy [16].

- Board Approval: For very large or complex transactions, final approval may be required from the bank’s Board of Directors.

4.1.3. Setting Credit Limits and Exposure Management

Banks establish credit limits for corporate clients to manage their overall exposure and concentration risk.

- Individual Borrower Limits: Based on the borrower’s creditworthiness, industry, and the bank’s risk appetite.

- Industry/Sector Limits: Caps on total exposure to specific industries to prevent over-concentration.

- Country Limits: Limits on exposure to borrowers in particular countries, considering political and economic risks.

- Exposure Monitoring: Continuous tracking of actual exposure against approved limits to ensure compliance and identify potential breaches [17].

4.2. Stage 2: Documentation and Legal Perfection

Once approved, the loan terms are formalized in legal documents.

- Term Sheet: A non-binding outline of the key terms and conditions of the proposed financing, serving as a basis for detailed documentation.

- Loan Agreement: The comprehensive legal contract detailing all aspects of the loan, including principal amount, interest rate, repayment schedule, covenants, representations and warranties, events of default, and governing law.

- Security Documents: Legal instruments (e.g., mortgages, pledges, charges) that create and perfect the lender’s security interest over the borrower’s assets. Perfection ensures the lender’s claim is legally enforceable and prioritized over other creditors.

- Intercreditor Agreement: In syndicated or multi-lender transactions, this agreement defines the rights and obligations of different lenders (e.g., senior vs. junior lenders) regarding collateral, payments, and enforcement actions.

- Conditions Precedent (CPs): A list of conditions that must be satisfied before the loan can be drawn down (e.g., submission of legal opinions, insurance certificates, corporate resolutions).

4.3. Stage 3: Loan Disbursement and Ongoing Management

This stage involves the actual funding of the loan and its active management throughout its term.

4.3.1. Drawdown Mechanism

- Borrower Request: The borrower submits a drawdown request, confirming that all conditions precedent for drawdown have been met.

- Agent Bank Role: In syndicated loans, the facility agent receives the request, verifies compliance, and notifies the syndicate members to fund their pro-rata share of the drawdown.

- Disbursement: Funds are transferred to the borrower’s account.

4.3.2. Loan Servicing and Monitoring

- Payment Processing: Collection of principal and interest payments according to the repayment schedule. This often involves automated systems within core banking platforms [18].

- Covenant Monitoring: Regular review of financial statements and other reports submitted by the borrower to ensure compliance with financial and non-financial covenants. Breaches may trigger specific actions by the lender.

- Relationship Management: Ongoing communication between the bank and the borrower to address any issues, discuss future financing needs, and maintain a strong banking relationship.

- Annual Reviews: Periodic comprehensive reviews of the borrower’s financial health, business performance, and market conditions to reassess risk and adjust credit terms if necessary.

4.4. Stage 4: Repayment, Renewal, or Recovery

The final stage of the loan lifecycle, determining the ultimate outcome of the financing.

4.4.1. Repayment

- Scheduled Repayments: Adherence to the agreed amortization schedule.

- Prepayments: Borrowers may prepay loans (in full or in part) if permitted by the loan agreement, often incurring a prepayment penalty.

- Maturity: Upon full repayment, the loan is closed, and any security interests are released.

4.4.2. Renewal or Refinancing

- Renewal: For RCFs or short-term facilities, the borrower may request a renewal of the facility, subject to a new credit assessment and negotiation of terms.

- Refinancing: Replacing an existing loan with a new one, often to secure better terms, extend maturity, or consolidate debt.

4.4.3. Loan Recovery (in case of Default)

If a borrower fails to meet its obligations (an Event of Default), the lender initiates recovery actions.

- Default Management: Early engagement with the borrower to understand the issues and explore potential solutions (e.g., waivers, amendments, restructuring).

- Loan Restructuring: Modifying the terms of the loan (e.g., extending maturity, adjusting interest rates, changing repayment schedules) to improve the borrower’s ability to repay and avoid formal default.

- Enforcement of Security: If restructuring is not feasible or successful, the lender may enforce its rights over the collateral to recover the outstanding debt.

- Legal Action: In some cases, legal proceedings may be initiated to recover funds.

Chapter 5: Advanced Risk Management in Corporate Lending

Effective risk management is paramount in corporate lending, encompassing various types of risks and sophisticated mitigation strategies.

5.1. Types of Risks

- Credit Risk: The risk that a borrower will default on its obligations. This is the primary risk in lending.

- Market Risk: Risk arising from adverse movements in market prices (e.g., interest rates, foreign exchange rates, commodity prices) that can impact the borrower’s ability to repay or the value of collateral.

- Operational Risk: Risk of loss resulting from inadequate or failed internal processes, people, and systems, or from external events (e.g., fraud, errors, system failures).

- Liquidity Risk: The risk that the bank may not be able to meet its own financial obligations as they fall due, potentially exacerbated by large loan drawdowns or defaults.

- Legal and Regulatory Risk: Risk of non-compliance with laws, regulations, and internal policies, leading to fines, penalties, or reputational damage.

- Reputational Risk: Damage to the bank’s reputation due to involvement in controversial loans or poor risk management practices.

5.2. Risk Mitigation Strategies

- Diversification: Spreading loan exposure across various industries, geographies, and borrower types to reduce concentration risk.

- Collateralization: Securing loans with assets to provide a secondary source of repayment.

- Covenants: Imposing conditions on borrowers to control their financial health and operational activities.

- Hedging: Using financial instruments (e.g., interest rate swaps, currency forwards) to mitigate market risks.

- Credit Derivatives: Transferring credit risk to third parties through instruments like Credit Default Swaps (CDS).

- Loan Syndication/Participation: Sharing loan exposure with other lenders to reduce individual risk.

Chapter 6: Conclusion

Corporate loan management is a dynamic and complex field, requiring a blend of financial acumen, legal expertise, and risk management proficiency. This guide has traversed the landscape of corporate lending, from the fundamental types of facilities and their operational intricacies to the critical aspects of fees, taxes, and the comprehensive loan lifecycle. By mastering these elements, professionals can navigate the challenges and opportunities within this vital sector of the financial industry, fostering sustainable growth for businesses and robust portfolios for lenders.

References

[1] Trimont. (2024, June 6). The importance of the facility agent and security trustee. Retrieved from https://trimont.com/news/2024/the-importance-of-the-facility-agent-and-security-trustee/

[2] LexisNexis. (2025, November 11). The security agent | Legal Guidance. Retrieved from https://www.lexisnexis.co.uk/legal/guidance/the-security-agent-security-trust-provisions

[3] Investopedia. (2025, August 2). Revolving Loan Facility: Flexible Financing for Businesses. Retrieved from https://www.investopedia.com/terms/r/revolving-loan-facility.asp

[4] ICICI Bank. (n.d.). Letter Of Credit – Trade Services – Business Banking. Retrieved from https://www.icici.bank.in/business-banking/trade-service/letter-of-credit

[5] Investopedia. (n.d.). Bank Guarantees and Letters of Credit: Key Differences. Retrieved from https://www.investopedia.com/ask/answers/difference-between-bank-guarantee-and-letter-of-credit/

[6] ICICI Bank. (n.d.). Letter Of Credit – Trade Services – Business Banking. Retrieved from https://www.icici.bank.in/business-banking/trade-service/letter-of-credit

[7] Investopedia. (n.d.). Bank Guarantees and Letters of Credit: Key Differences. Retrieved from https://www.investopedia.com/ask/answers/difference-between-bank-guarantee-and-letter-of-credit/

[8] Investopedia. (2025, August 27). Special Purpose Vehicle (SPV): Definition and Reasons. Retrieved from https://www.investopedia.com/terms/s/spv.asp

[9] Pivotal180. (2021, April 20). Project Finance Cash Flow Waterfall – Priority, Structure & Example. Retrieved from https://pivotal180.com/project-finance-cash-flow-waterfall/

[10] PwC. (n.d.). United States – Corporate – Withholding taxes. Retrieved from https://taxsummaries.pwc.com/united-states/corporate/withholding-taxes

[11] JD Supra. (2023, March 1). Facility Fees and Accrual | Seward & Kissel LLP. Retrieved from https://www.jdsupra.com/legalnews/facility-fees-and-accrual-3874591/

[12] Wall Street Prep. (n.d.). Commitment Fee | Formula + Calculation Example. Retrieved from https://www.wallstreetprep.com/knowledge/commitment-fee/

[13] Investopedia. (2023, June 14). Utilization Fee: Definition, Example, vs. Commitment Fee. Retrieved from https://www.investopedia.com/terms/u/utilization-fee.asp

[14] PwC. (n.d.). United States – Corporate – Withholding taxes. Retrieved from https://taxsummaries.pwc.com/united-states/corporate/withholding-taxes

[15] Deloitte. (2025, August 6). Thin capitalization. Retrieved from https://www.deloitte.com/tz/en/services/tax/perspectives/thin-cap-rule.html

[16] FE Training. (2022, May 6). Credit Approval. Retrieved from https://www.fe.training/free-resources/credit/credit-approval/

[17] Investopedia. (n.d.). Understanding Credit Exposure: Managing Loan Risks. Retrieved from https://www.investopedia.com/terms/c/credit-exposure.asp

[18] ServiceNow. (n.d.). Loan Drawdown workflow. Retrieved from https://www.servicenow.com/docs/bundle/zurich-financial-services-operations/page/product/fso-loan-operations/concept/loan-drawdown-workflow.html